Insights Blog

How Invoice Factoring Can Help Lessen Periodic Business Fluctuations

Operating a business with seasonal patterns can present significant financial obstacles. Learn how to navigate the ups and downs caused by seasonal shifts and how invoice factoring can provide consistent cash flow, reducing credit line dependency. Discover how invoice factoring can help you handle seasonal fluctuations and ensure sustained business success.

What is the Difference Between Invoice Factoring and Invoice Discounting?

In our latest blog post, we delve into the distinctions between invoice factoring and invoice discounting, providing you with the essential information needed to make the right financial choice for your company. Understanding the unique benefits and considerations of each option can help you access the working capital you need and ensure a stable financial future.

Why Invoice Numbers Are More Important Than You Think

In our latest blog article, we reveal why invoice numbers are more crucial than you may think. Discover how invoice numbers facilitate seamless organization, minimize errors, and streamline record-keeping. Learn essential best practices, including consistency, date-based elements, and client or project codes, that can optimize your financial insights and ensure compliance.

How to Improve Your Business Credit Score

Credit scores play a crucial role in determining a company’s financial health and reputation, providing lenders, suppliers, and other business partners a snapshot of your ability to manage its financial obligations. In this blog article, we explore what business credit scores are, why they matter and how you can improve them to strengthen your company’s financial standing.

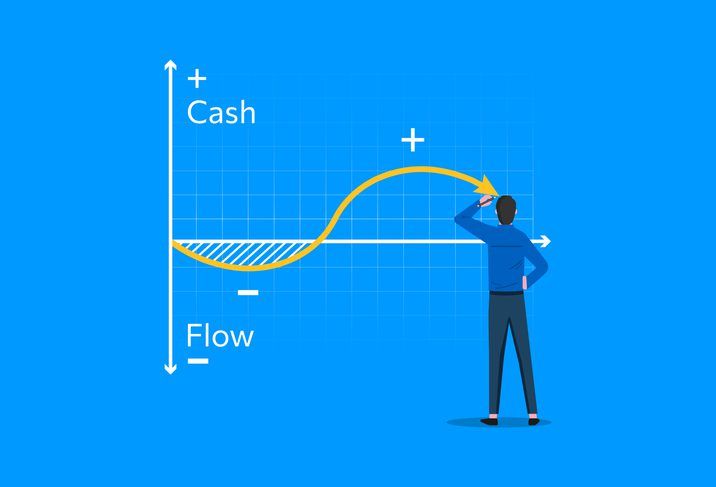

The Impact of Poor Cash Flow Management on Your Business

Effective cash flow management ensures there’s enough funds to cover expenses, pay employees, invest in growth and maintain financial stability. Yet, many businesses struggle with cash flow significantly impacting their operations and long-term success. In this blog article, we provide actionable solutions to address these challenges.

Boost Your Marketing Success With Effective Working Capital Management

Achieve marketing success through effective working capital management. In our latest blog article, you’ll discover strategies for budget allocation, campaign optimization, and customer acquisition. Learn how to optimize working capital to enhance your marketing efforts and out perform competitors.

Universal Funding Launches Newly Designed Website

Universal Funding recently launched its newly designed website. Our goal is to make information regarding our services, how businesses can improve cash flow, and financial trends easily accessible for our current and prospective clients as well as referral partners. With this in mind, we have implemented a range of enhancements to make our website navigation smoother, faster, and more intuitive.

How to Handle Overdue Invoices

Struggling to manage overdue invoices without straining customer relationships? In our latest blog article, we share actionable strategies to collect overdue invoices effectively. You’ll discover practical tips on clear communication, flexible payment options, and the power of invoice factoring. Learn how to maintain positive customer connections while ensuring prompt payments.

7 Key Strategies for Maximizing Working Capital

Improving working capital is a critical aspect of achieving sustainable growth and financial stability for business owners. By exploring various business owners can optimize their working capital, enhance liquidity, and position themselves for long-term success. In this blog article, you’ll learn valuable insights and actionable tips.